– November 10, 2025

When it comes to charitable giving, many donors want to make a lasting impact while also being strategic about tax benefits. A Donor-Advised Fund (DAF) is one of the most flexible and tax-efficient tools available for achieving both.

What Is a Donor-Advised Fund?

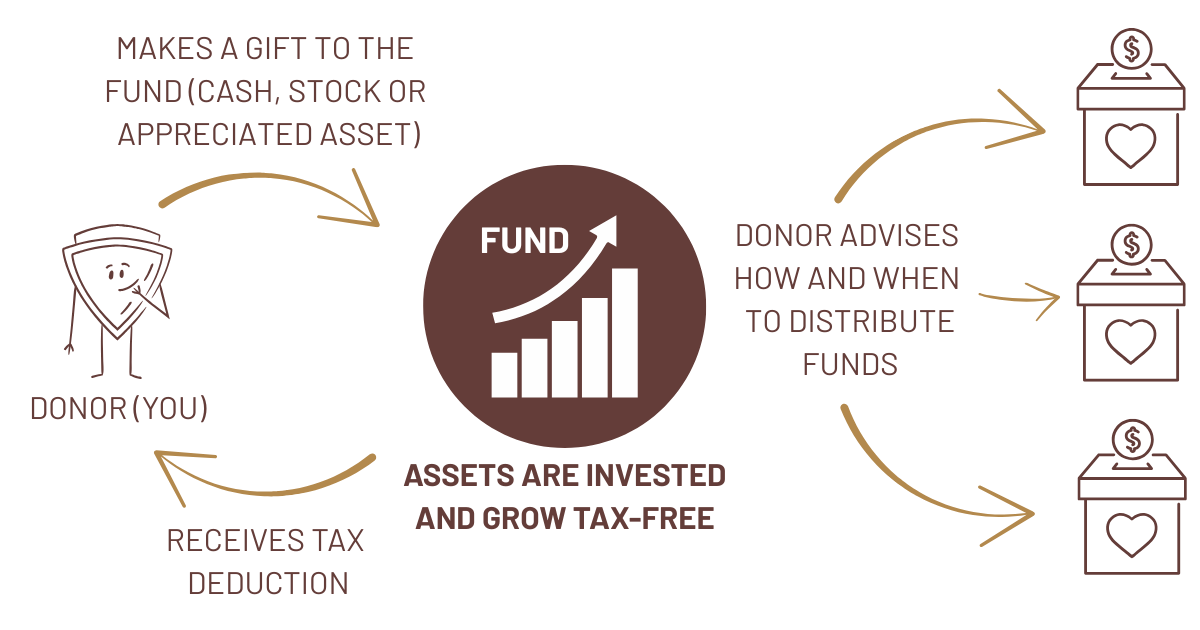

A DAF is a charitable investment account designed to support the causes you care about most. You make a contribution—whether it’s cash, stocks, or other appreciated assets—receive an immediate tax deduction, and then recommend grants from the fund over time to qualified charities.

This structure allows you to separate the timing of your tax deduction from your actual charitable giving, giving you more flexibility and control.

How It Works

- Contribute: Donate cash, securities, or other appreciated assets to the fund.

- Receive Tax Benefits: Claim an immediate charitable tax deduction (subject to IRS limits).

- Grow Your Impact: The assets in the DAF are invested and grow tax-free.

- Recommend Grants: Over time, you choose which IRS-qualified charities to support and when.

For example, if John contributes $100,000 of appreciated stock originally purchased for $50,000, he can deduct the full $100,000 fair market value while avoiding capital gains taxes on the $50,000 in appreciation. His DAF can then distribute grants to his favorite causes over time.

Key Benefits of a DAF

- Immediate Tax Deduction: Take a deduction in the year you contribute—even if grants are made later.

- Tax-Free Growth: Investments inside the DAF grow tax-free, potentially increasing your charitable power.

- Flexibility & Simplicity: Support multiple organizations without managing separate donations or receipts.

- Legacy Planning: Name successors or charitable beneficiaries to continue your giving for generations.

Eligible Contributions

DAFs can accept a variety of assets, including:

- Cash

- Publicly traded securities

- Private business interests

- Cryptocurrency (varies by sponsor)

- Other appreciated assets

Tax Considerations

- Deduct up to 60% of AGI for cash contributions and up to 30% of AGI for appreciated assets.

- Unused deductions can be carried forward up to five years.

- Donating appreciated assets can eliminate capital gains taxes on those assets.

Is a Donor-Advised Fund Right for You?

A DAF may be ideal if you:

- Want to make a meaningful impact in a tax-efficient way.

- Are seeking a simple solution for managing year-end or ongoing giving.

- Would like to involve your family in multi-generational philanthropy.

Getting Started

Setting up a DAF is straightforward and can be done through major providers such as Fidelity Charitable, Schwab Charitable, or Pershing/BNY Mellon Charitable Gift Fund. Your financial advisor can help determine the best approach and ensure your giving aligns with your broader wealth and estate strategy.

Ready to Learn More?

At TOVA Wealth, our advisors can help you evaluate whether a DAF aligns with your broader financial and legacy objectives.

📍 TOVA Wealth — Wilmington, NC

🔗 www.tovawealth.com | ☎ 910-408-5522