– January 21, 2026

For individuals looking to support meaningful causes while also making smart tax decisions, Qualified Charitable Distributions (QCDs) offer one of the most powerful tools available. If you’re age 70½ or older, a QCD allows you to donate directly from your IRA to a qualified charity—without counting that distribution as taxable income.

Below, we’ll break down how QCDs work, why they matter, and how you can use them to support the organizations you care about while also optimizing your financial plan.

What Is a Qualified Charitable Distribution?

A Qualified Charitable Distribution is a direct transfer of funds from your Individual Retirement Account (IRA) to a qualified 501(c)(3) charity. For 2025, individuals can contribute up to $108,000 per year as a QCD. Married couples filing jointly may each contribute up to the limit from their individual IRAs.

Because the donation goes straight from your IRA to the charity, the amount doesn’t count toward your taxable income—making this approach significantly more tax-efficient than withdrawing the funds first and donating afterward.

Why QCDs Are a Smart Strategy

1. Tax-Free Giving

The portion of your IRA distribution made as a QCD is excluded from your taxable income, which can significantly reduce your overall tax liability.

2. Satisfies Your Required Minimum Distribution (RMD)

If you’re age 73 or older, you must take RMDs each year. QCDs can count toward your RMD, allowing you to meet the requirement without increasing your taxable income.

3. No Need to Itemize

Even if you take the standard deduction, you still receive the full tax benefit of a QCD—something traditional charitable deductions can’t offer unless you itemize.

4. Can Reduce Medicare Premiums & Social Security Taxes

Because QCDs lower your Adjusted Gross Income (AGI), they may help:

-

Reduce taxes on Social Security benefits

-

Lower income-related Medicare premium surcharges

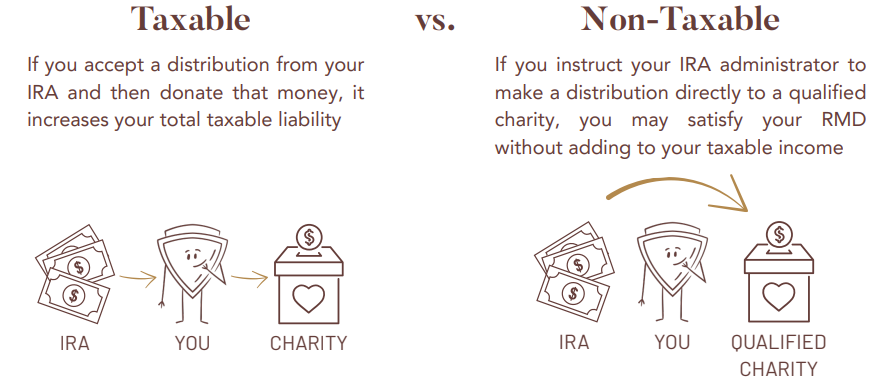

QCDs vs. Traditional Giving

Traditional Donation (Taxable)

If you withdraw money from your IRA and then donate it:

-

The withdrawal adds to your taxable income

-

You may not benefit unless you itemize deductions

-

Higher income may trigger increased taxes or premiums

Qualified Charitable Distribution (Non-Taxable)

If you instruct your IRA custodian to send funds directly to the charity:

-

The distribution is not added to your taxable income

-

It can satisfy your RMD

-

You receive the tax benefit even with the standard deduction

Eligibility Requirements for QCDs

To complete a Qualified Charitable Distribution:

Age:

You must be 70½ or older at the time of the distribution.

Eligible Accounts:

QCDs may come from:

-

Traditional IRAs

-

Inherited IRAs

-

SEP or SIMPLE IRAs (only if the plan is inactive)

Eligible Charities:

Must be qualified 501(c)(3) charities.

Not eligible:

-

Donor-advised funds

-

Private foundations

-

Supporting organizations

How to Complete a QCD

-

Contact your IRA custodian and request a direct transfer to the charity.

-

The check must be made payable to the charity—not to you.

-

-

Obtain a written acknowledgment from the charity for your tax records.

-

Report the QCD on your tax return, following IRS guidelines (your tax professional can help ensure accuracy).

A Real-World Example

Mary, age 75, must take a $20,000 RMD this year. She chooses to donate $10,000 directly to a qualified charity through a QCD.

Here’s what happens:

-

The $10,000 QCD satisfies half of her RMD

-

She only reports the remaining $10,000 as taxable income

-

She supports a cause she loves and reduces her tax bill

Important Considerations

-

QCDs must be completed by December 31 to count for the current tax year

-

Always consult with your tax advisor before completing a QCD

-

Keep all paperwork from your IRA custodian and the charity

Final Thoughts

Qualified Charitable Distributions can be a win-win for retirees interested in philanthropy and tax efficiency. By donating directly from your IRA, you reduce taxable income, potentially lower Medicare and Social Security–related costs, meet your RMD requirement, and make a meaningful impact on the organizations that matter most to you.

Ready to Learn More?

If you’re considering incorporating QCDs into your giving strategy, reach out to your advisor at TOVA Wealth to ensure they align with your broader financial goals.

📍 TOVA Wealth — Wilmington, NC

🔗 www.tovawealth.com | ☎ 910-408-5522