Market Commentary – January 20, 2026

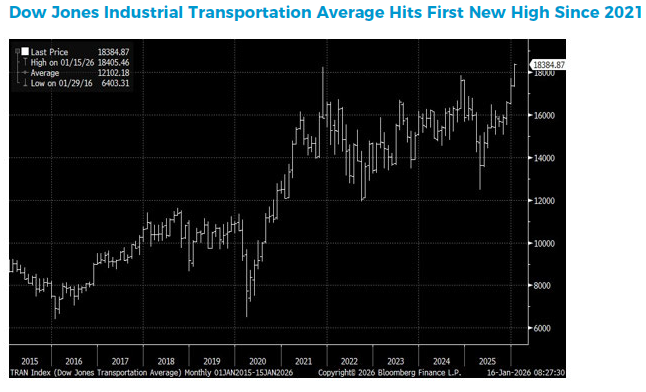

The equity market is finally broadening out with the Dow Jones Industrial Transportation Average (DJTA) breaking to new all-time highs, finally surpassing its November 2021 high.

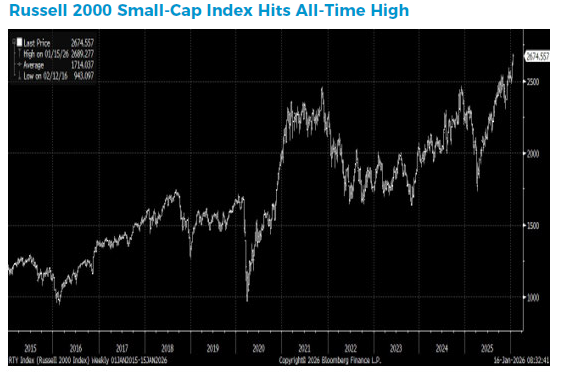

Small caps have moved to record highs along with the equal-weighted S&P 500. The broadening out of the market has moved the NYSE Cumulative Advance–Decline Line to an all-time high along with our volume model moving to record highs – both indicators confirming the breakouts in the market. This is evidence that the bull market continues to charge forward in 2026 – but just with higher volatility, which remains one of our themes for the year ahead. The S&P 500 remains overbought, which could lead to additional volatility, but investors should remain fearless as we do expect the S&P 500 to reach 7500 by year-end for an 8% gain from current levels.

Small Caps: False Rally Or Is It Real This Time?

We have been negative on small caps for years, but the group is finally enjoying a strong rally. While small caps are known to outperform in January (a seasonal pattern known as the January Effect), investors are now asking whether this rally signals a more durable period of outperformance relative to large caps. Small caps have not done well due to weaker earnings power, particularly when compared with mega-cap stocks. However, recent data suggests that small-cap earnings have bottomed and are beginning to improve. Earnings estimate revisions are turning higher, and year-over-year earnings forecasts appear to have bottomed. The equity market trades on the change in direction of asset classes. With a trough and improvement in earnings for small caps, this rally may just be real! When we look at how small caps are performing relative to large caps, they are breaking an important downtrend. If this holds, it would also confirm that small caps have made a bottom relative to large caps. We would begin to consider adding small caps to portfolios for diversification. We believe this is the year portfolios need diversification, particularly to defend against market volatility.