Market Commentary – December 8, 2025

Much of the action this week revolves around the Federal Reserve (Fed). On Wednesday, the FOMC (Federal Reserve Open Market Committee), which sets monetary policy, will conclude its semi-quarterly meeting, and the market expects the FOMC to lower interest rates with a quarter-point cut (25 bps).

But the Committee is deeply divided – more so than at any time since the early 1980s, when the Fed was finally taming inflation. Adding to the uncertainty, President Trump has indicated that he has selected a yet-to-be-named new Federal Reserve Chair, replacing Jerome Powell. Although Powell’s term does not end until May, many observers believe this will make him a lame duck chairman. However, markets don’t like uncertainty, so once the Fed chair successor is named, the market will shift its focus to what Fed policy direction is likely to be heading into the latter part of 2026.

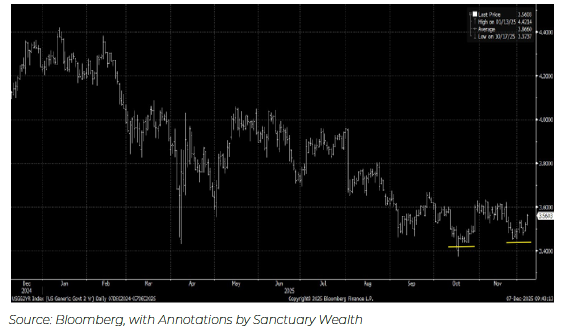

Risk: 2-Year Treasury Yields Rise

There is a seasonal bias for short-term rates to rise into December and the first quarter of the new year as companies have a higher demand for cash to settle their books for the year. On top of that, the Fed meeting this week has the market pricing in a 96% probability that interest rates will get cut by 25 basis points. The Fed is most likely not going to disappoint investors and will lower rates, but their comments may have a hawkish tone. So, the risk we see this week is that short rates can rise, in particular the 2-Year Treasury yield. We maintain rates are most likely to remain in a downtrend, but short term, they can rally to 3.8%-4.0%. We would be braced for some volatility in rates and stocks this week.

2-Year Treasury Yield – Risk Of A Double Bottom

Keep reading:

Loading...

Loading...